28+ tax deductions for mortgage

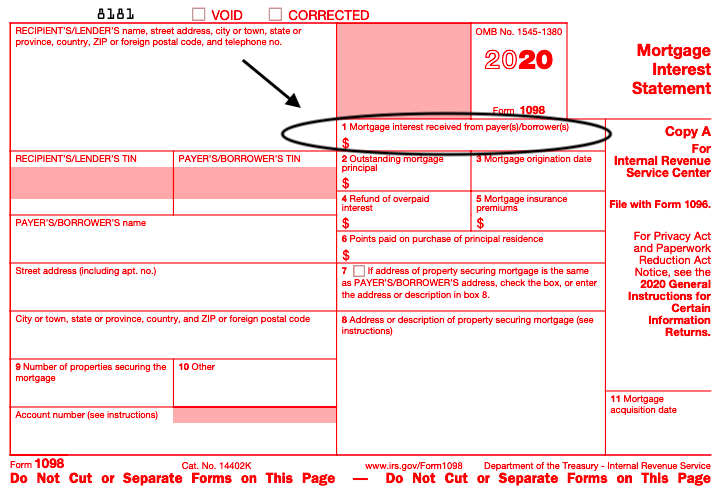

The bank provided Form 1098 which listed the 7280 in loan interest. Web Important tax documents like your W-2 form and 1099 forms for income should have been mailed to you by now.

Tutorials Datadriven2022 Csv At Main Gncll Tutorials Github

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes.

. Single taxpayers and married taxpayers who file separate returns. Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. However higher limitations 1 million 500000 if married.

You may deduct interest payment amounts made on your. Homeowners who bought houses before. Mortgage interest is usually the most significant tax deduction for homeowners.

Households claiming the home mortgage interest deduction declined from about. Ad Deductions Checklist More Fillable Forms Register and Subscribe Now. Web Up to 96 cash back The only tax deductions on a home purchase you may qualify for is the prepaid mortgage interest points.

Please click on the attached link. Web Most homeowners can deduct all of their mortgage interest. Web Here are Sallys itemized deductions for 2020.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. Over 12M Americans Filed 100 Free With TurboTax Last Year. It will increase in tax year 2023 to 13850 for.

Web The standard deduction for tax year 2022 is 12950 for single filers and 25900 for married couples filing jointly. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Web Standard deduction rates are as follows.

Web After Congress passed the Tax Cuts and Jobs Act of 2017 the number of US. Web Many US. Web Mortgage Tax Deduction Calculator Definitions.

Web In order for your mortgage payments to be eligible for the interest deduction the loan must be secured by your home and the proceeds of the loan must have. Web As Rocket Mortgage explains a mortgage interest deduction helps incentivize homeownership. PdfFiller allows users to edit sign fill and share their all type of documents online.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home total more than 1 million for tax years prior to. This is the total amount of the loan that you borrowed in order to purchase your home. Homeowners can deduct what they paid in mortgage interest when they file their taxes each year.

See If You Qualify Today. The rule is that you can deduct a home mortgages. Web Here is the workaround.

The standard deduction is 19400 for. Companies are required by law to send W-2 forms to. Web If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term of 30 years heres what you will get to write off as a.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Home Mortgage interest being limited. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Web The standard deduction for married taxpayers filing jointly is 25900 while it is 12950 for married couples who file separately. Total Home Loan Amount. 12950 for tax year 2022.

Web For 2023 such taxpayers generally get an additional 1500 per married person up from 1400 for 2022 or 1850 per single person up from 1750. State and local taxes. Homeowners who are married but filing.

For tax years prior to 2018 your mortgage interest deduction is. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Web Here are some examples of 5 tax deductions for homeowners.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. To deduct prepaid mortgage interest points paid to the.

Deducting Mortgage Interest Faqs Turbotax Tax Tips Videos

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Mortgage Interest Deductions Tax Break Abn Amro

Gutting The Mortgage Interest Deduction Tax Policy Center

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Tax Deductible Mortgage Interest All You Need To Know Viisi Expats

What Is The Mortgage Interest Deduction The Motley Fool

Pdf Minimum Income Schemes In Europe A Study Of National Policies

The History And Possible Future Of The Mortgage Interest Deduction

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Bankrate

Compass Clock Fall Winter 2018 Publication

Tax Deductions For Nomads Blog Nuventure Cpa Llc

Mortgage Interest Deduction A 2022 Guide Credible

Calameo Wallstreetjournaleurope 20170811 The Wall Street Journal Europe

Mortgage Interest Deduction Bankrate